Join our newsletter

Subscribe and stay tuned with the latest tendencies about technology

Sign up real users, secure forex transactions or sign online contracts in minutes within more than 190 regulated and unregulated markets.

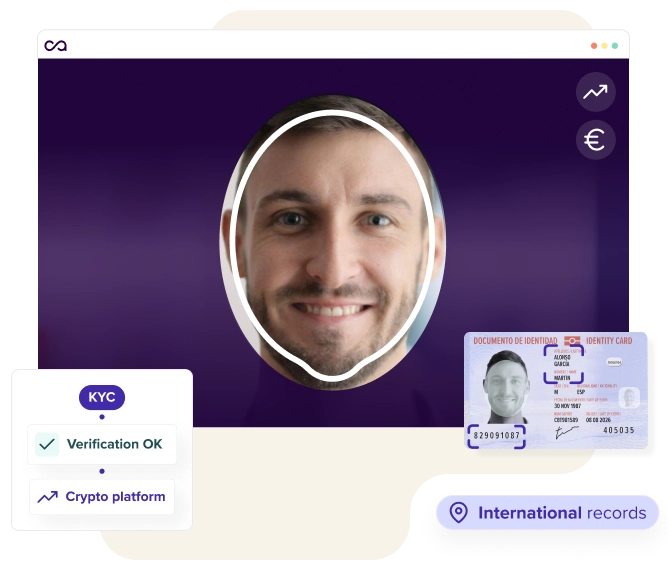

Talk to an expertRegulations such as MiCA in Europe are imposing instant KYC, KYB and AML checks on crypto exchanges and other services related to investment, trading and cryptoassets. They prevent fraud, sign secure transactions and save costs in lots of processes.

New user registration can be streamlined, private and 100% secure at the same time. Use the best tools from FinTech leaders with AI to make more customers in less time.

Get record of operations performed and offer additional services based on contracts with full support and comfort. All under the same process and flow.

Security is no longer a desirable issue, but a must-have. Avoid losses and bad reputation by working with reliable customers and partners

High conversion rates, compliance systems tailored to your preferences and modular security.

Simple customer forms, linked to international registries and reliable identity verification with global legal backing.

No customer data or information is stored. Tecalis sends OK or KO to register in seconds new users who can operate in crypto or trading.

Prioritize a frictionless experience and convey a sense of ease that boosts your sign-ups and reduces onboarding abandonment rates.

Automation solutions for regulatory and privacy compliant new user acquisition.

In the same flow as identity verification and KYC/AML controls, integrate digital signature for acceptance of terms and conditions, product/service contracting and much more. Full legal support.

Learn moreIntegrate +50 controls to prevent fraud in dozens of processes and operations without your users perceiving slowness or strict requirements. In the background, Tecalis checks dozens of variables to protect you.

Learn moreSend electronic notifications to your users with full traceability. Register their movements or notify them of events relevant to the service with regulatory support.

Learn moreDiscuss with our experts how Tecalis can help you grow your business